OpenPEPPOL AISBL, Post-Award Coordinating Community v0.1.2

Link to main site of documentation

Introduction

The main requirement for specification comes from the fact that Japan uses Japanese Consumption Tax, which concept is as same as Value Added Tax (VAT). This has consequences on code lists and the naming of some business terms.

This specification is based on the Peppol International model.

The purpose of this document is to describe the use of the invoice and credit note messages in Peppol, and to facilitate an efficient implementation and increased use of electronic collaboration regarding the billing process based on these formats.

Document Structure

This document is structured as follows:

-

Chapter 1 gives general information on the business processes, requirements and functionalities.

-

Chapter 2 provides information on business related requirements supported by the invoice.

-

Chapter 3 provides information on legal and tax related requirements supported by the invoice.

-

Chapter 4 provides information about rules and calculations that applies to the invoice content.

-

Chapter 5.1 describes the BIS identifiers.

-

Chapter 5.2 describes the semantical data types.

-

Chapter 5.3 gives external links to the relevant UBL schemas.

Scope

This document is concerned with clarifying requirements for ensuring interoperability and provides guidelines for the support and implementation of these requirements. This document will also provide a detailed implementation guideline for the invoice and credit note transactions.

Audience

The audience for this document is organisations wishing to be Peppol enabled for exchanging electronic invoices, and/or their ICT-suppliers. These organisations may be:

-

Service providers

-

Contracting Authorities (CA)

-

Economic Operators (EO)

-

Software Developers

More specifically, roles addressed are the following:

-

ICT Architects

-

ICT Developers

-

Business Experts

For further information on Peppol/OpenPEPPOL see http://peppol.org

Benefits

The invoice and credit note provides simple support for complex invoicing, where there is a need for credit note in addition to an invoice. Other potential benefits are, among others:

-

Can be mandated as a basis for national or regional eInvoicing initiatives.

-

Procurement agencies can use them as basis for moving all invoices into electronic form. The flexibility of the specifications allows the buyers to automate processing of invoices gradually, based on different sets of identifiers or references, based on a cost/benefit approach.

-

SME can offer their trading partners the option of exchanging standardised documents in a uniform way and thereby move all invoices/credit notes into electronic form.

-

Large companies can implement these transactions as standardised documents for general operations and implement custom designed bi-lateral connections for large trading partners.

-

Supports customers with need for more complex interactions.

-

Can be used as basis for restructuring of in-house processes of invoices.

-

Significant saving can be realised by the procuring agency by automating and streamlining in-house processing. The accounting can be automated significantly, approval processes simplified and streamlined, payment scheduled timely and auditing automated.

1. Business processes

1.1. Parties and roles

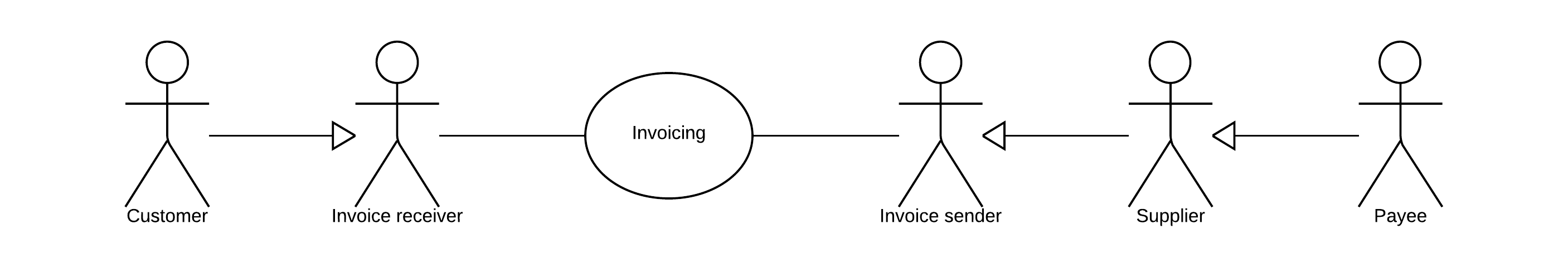

The diagram below shows the roles involved in the invoice and credit note transactions. The customer and invoice receiver is the same entity, as is the supplier and the invoice sender.

1.1.1. Parties

- Customer

-

The customer is the legal person or organisation who is in demand of a product or service. Examples of customer roles: buyer, consignee, debtor, contracting authority.

- Supplier

-

The supplier is the legal person or organisation who provides a product or service.

1.1.2. Roles

- Creditor

-

One to whom a debt is owed. The party that claims the payment and is responsible for resolving billing issues and arranging settlement. The party that sends the invoice or credit note. Also known as invoice issuer, accounts receivable or seller.

- Debtor

-

One who owes debt. The party responsible for making settlement relating to a purchase. The party that receives the invoice or credit note. Also known as invoicee, accounts payable, or buyer.

1.2. PINT Billing process

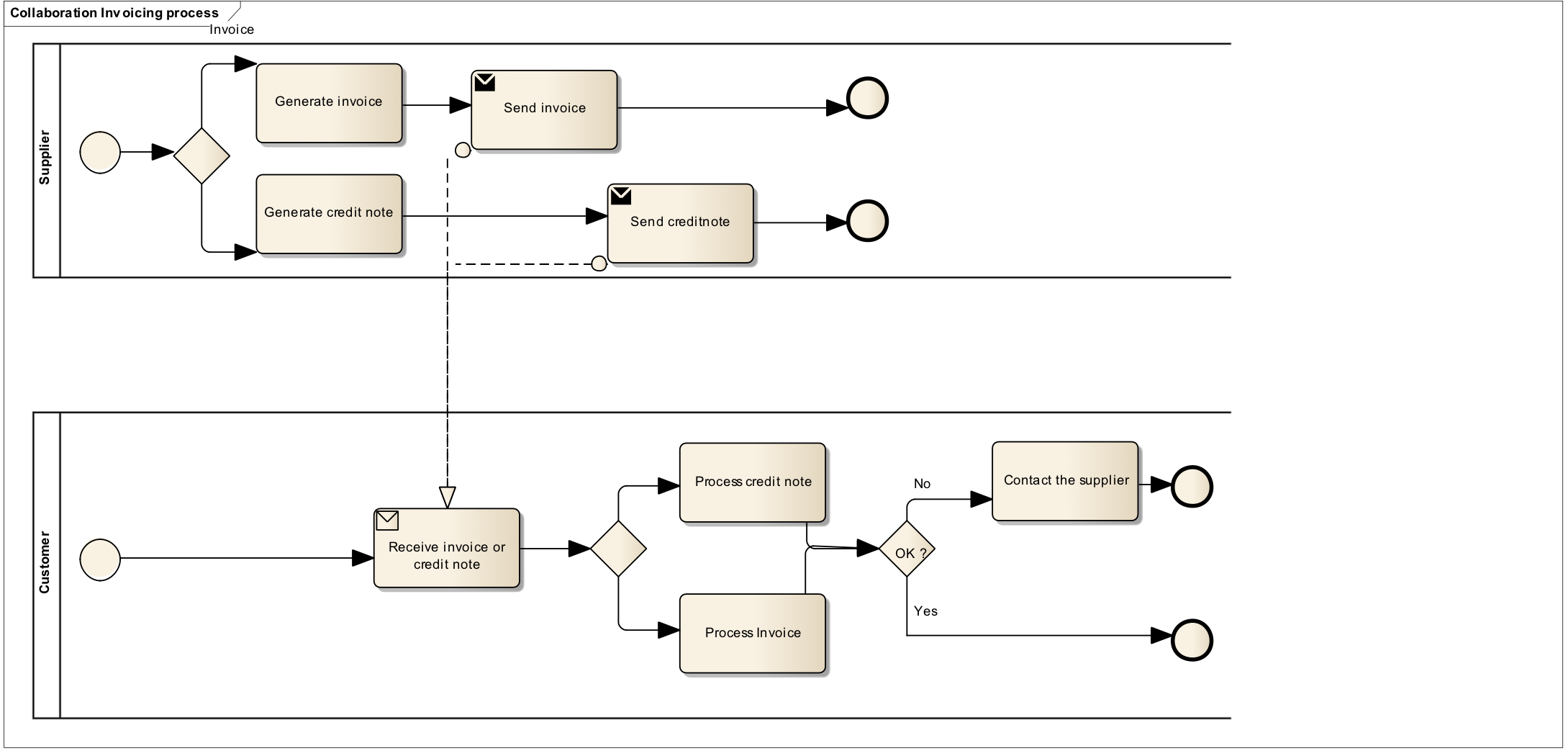

The invoicing process includes issuing and sending the invoice and the credit note from the supplier to the customer and the reception and handling of the same at the customer’s site.

The invoicing process is shown in this workflow:

-

A supplier issues and sends an invoice to a customer. The invoice refers to one order and a specification of delivered goods and services.

An invoice may also refer to a contract or a frame agreement. The invoice may specify articles (goods and services) with article number or article description.

-

The customer receives the invoice and processes it in the invoice control system leading to one of the following results:

-

The customer fully approves the invoice, posts it in the accounting system and passes it on to be paid.

-

The customer completely rejects the invoice, contacts the supplier and requests a credit note.

-

The customer disputes parts of the invoice, contacts the supplier and requests a credit note and a new invoice.

-

The diagram below shows the basic invoicing process with the use of this PEPPOL BIS profile. This process assumes that both the invoice and the credit note are exchanged electronically.

This profile covers the following invoice processes:

| P1 |

Invoicing of deliveries of goods and services against purchase orders, based on a contract |

| P2 |

Invoicing deliveries of goods and services based on a contract |

| P3 |

Invoicing the delivery of an incidental purchase order |

| P4 |

Pre-payment |

| P5 |

Spot payment |

| P6 |

Payment in advance of delivery |

| P7 |

Invoices with references to a despatch advice |

| P8 |

Invoices with references to a despatch advice and a receiving advice |

| P9 |

Credit notes or invoices with negative amounts, issued for a variety of reasons including the return of empty packaging |

1.3. Invoice functionality

An invoice may support functions related to a number of related (internal) business processes. This Peppol BIS shall support the following functions:

-

Accounting

-

Invoice verification against the contract, the purchase order and the goods and service delivered

-

Tax reporting

-

Auditing

-

Payment

In the following chapters an assessment is made of what information is needed for each of the functions listed above and whether it is in scope or out of scope for this Peppol BIS.

Explicit support for the following functions (but not limited to) is out of scope:

-

Inventory management

-

Delivery processes

-

Customs clearance

-

Marketing

-

Reporting

1.3.1. Accounting

Recording a business transaction into the financial accounts of an organization is one of the main objectives of the invoice. According to financial accounting best practice and CT rules every Taxable person shall keep accounts in sufficient detail for CT to be applied and its application checked by the tax authorities. For that reason, an invoice shall provide for the information at document and line level that enables booking on both the debit and the credit side.

1.3.2. Invoice verification

This process forms part of the Buyer’s internal business controls. The invoice shall refer to an authentic commercial transaction. Support for invoice verification is a key function of an invoice. The invoice should provide sufficient information to look up relevant existing documentation, electronic or paper, for example, and as applicable:

-

the relevant purchase order

-

the contract

-

the call for tenders, that was the basis for the contract

-

the Buyer’s reference

-

the confirmed receipt of the goods or services

-

delivery information

An invoice should also contain sufficient information that allows the received invoice to be transferred to a responsible authority, person or department, for verification and approval.

1.3.3. Auditing

Companies audit themselves as means of internal control or they may be audited by external parties as part of a legal obligation. Accounting is a regular, ongoing process whereas an audit is a separate review process to ensure that the accounting has been carried out correctly. The auditing process places certain information requirements on an invoice. These requirements are mainly related to enable verification of authenticity and integrity of the accounting transaction.

Invoices, conformant to this PEPPOL BIS support the auditing process by providing sufficient information for:

-

identification of the relevant Buyer and Seller

-

identification of the products and services traded, including description, value and quantity

-

information for connecting the invoice to its payment

-

information for connecting the invoice to relevant documents such as a contract and a purchase order

1.3.4. Tax Reporting

The invoice is used to carry Tax related information from the Seller to the Buyer to enable the Buyer and Seller to correctly handle Tax booking and reporting. An invoice should contain sufficient information to enable the Buyer and any auditor to determine whether the invoice is correct from a Tax point of view.

The invoice shall allow the determination of the Tax regime, the calculation and description of the tax, in accordance with the relevant legislation.

1.3.5. Payment

An invoice represents a claim for payment. The issuance of an invoice may take place either before or after the payment is carried out. When an invoice is issued before payment it represents a request to the Buyer to pay, in which case the invoice commonly contains information that enables the Buyer, in the role of a debtor, to correctly initiate the transfer of the payment, unless that information is already agreed in prior contracts or by means of payment instructions separately lodged with the Buyer.

If an invoice is issued after payment, such as when the order process included payment instructions or when paying with a credit card, online or telephonic purchases, the invoice may contain information about the payment made in order to facilitate invoice to payment reconciliation on the Buyer side. An invoice may be partially paid before issuing such as when a pre-payment is made to confirm an order.

Invoices, conformant with this specification should identify the means of payment for settlement of the invoice and clearly state what payment amount is requested. They should provide necessary details to support bank transfers. Payments by means of Credit Transfer, Direct debit, and Payment Card are in scope.

1.4. Credit notes and negative invoices

Reverting an invoice that has been issued and received can be done in two basic ways. Either by issuing a credit note or a negative invoice.

-

When crediting by means of a credit note, the document type code is '381' (or its synonym), and the credit note quantities and extension/total amounts have the same sign (plus or minus) as the invoice that is being cancelled/credited. The document type code acts as an indicator that the given amounts are booked in reverse and cancel out the invoice amounts.

-

When crediting by means of a negative invoice, the document type code is '380' (or its synonym), and the negative invoice quantities and extension/total amounts have the opposite sign (minus vs plus) as the invoice being cancelled/credited. It is the mathematical sign that indicates that when the amounts are booked they cancel out the original amounts. The Price Amount must always be positive.

A credit note may include negative amounts when cancelling an invoice that may have negative line items/amounts.

Invoice-generating systems may implement either option, while Invoice-receiving systems must support both options. This can however be affected by legal requirements.

2. Local business process

Following sections describe how this specification is applied to support local business processes.

2.1. Summarised invoice process

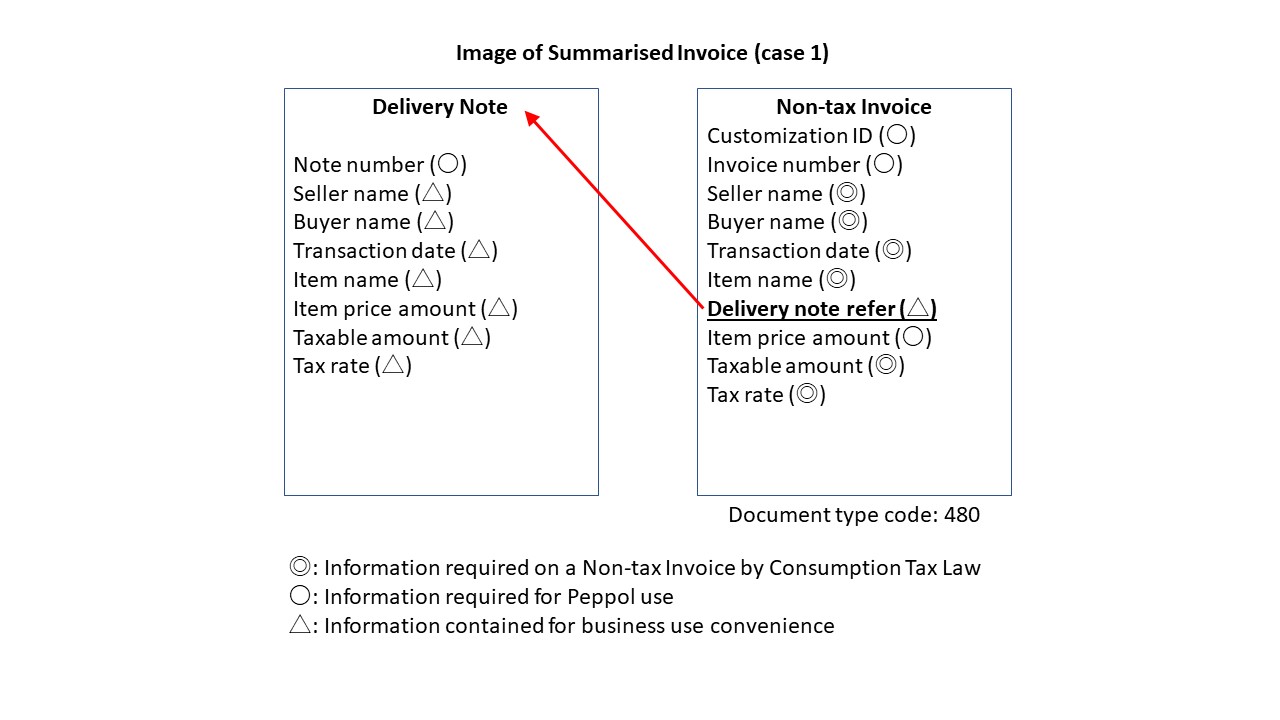

In Summarised invoicing process, the supplier sends a Delivery Note to the customer with each delivery and the buyer uses the information in the Delivery Note to verify the reception of the items.

The Delivery Note is focused on providing information about the items that are being delivered. At the end of a period (usually a month) the supplier sends an invoice that summarises the items that were delivered during that period. The invoice contains represents a claim for payment and contains all information required by Consumption tax law as a Non-tax Invoice, in principle.

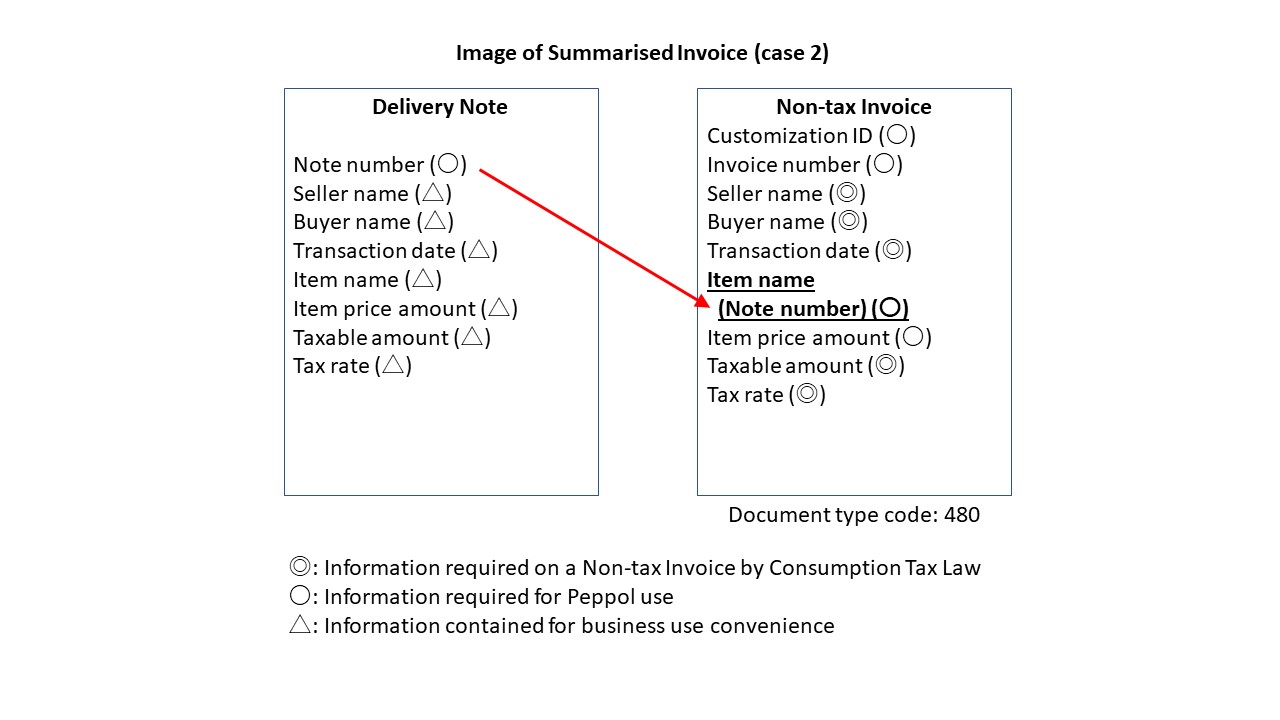

However, in practice, there is a case where an invoice doesn’t contain all information required as a Non-tax Invoice. For instance, there is a case where the Delivery Note Number is just mentioned in the Item name of the invoice. In such a case, it is usual that the necessary information (maybe, information related to Item name) is included in the Delivery Note.

So, in Japan, there is a case where the combination of the invoice and the Delivery Note works as a Non-tax Invoice and the customer can claim input tax credit by retaining both of them.

The Summarised invoicing process is shown in the followings.

-

A supplier can send one or more Delivery Note along with the deliveries of items. The Delivery Note refers to the order and provides information about items delivered. The customer can use it to control the reception of the items.

-

At the end of a period, the supplier issues an invoice to the customer. The invoice summarises all the items delivered during the period and refers to each Delivery Note.

-

The customer receives the invoice and processes it in the invoice control system leading to one of the following results;

-

The customer fully approves the invoice, posts it in the accounting system and passes it on to be paid.

-

The customer completely rejects the invoice, contacts the supplier and requests a credit note.

-

The customer disputes parts of the invoice, contacts the supplier and requests a credit note and a new invoice.

-

This profile covers the same processes as Standard invoicing process.

3. Business information

In the subchapters below you find description of selected parts of the transaction.

3.1. Parties

The following roles may be specified. The same actor may play more than one role depending on the handling routine.

Further details on the roles/actors can be found in Roles.

3.1.1. Seller (AccountingSupplierParty)

Seller is mandatory information and provided in element cac:AccountingSupplierParty

<cac:AccountingSupplierParty>

<cac:Party>

<cbc:EndpointID schemeID="0188">1234567890123</cbc:EndpointID> (1)

<cac:PartyIdentification>

<cbc:ID schemeID="0147">123456:000123:0147:1</cbc:ID> (2)

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>株式会社 〇〇商事</cbc:Name> (3)

</cac:PartyName>

<cac:PostalAddress>

<cbc:StreetName>四谷4-29-X</cbc:StreetName>

<cbc:AdditionalStreetName>〇〇商事ビル</cbc:AdditionalStreetName>

<cbc:CityName>新宿区</cbc:CityName>

<cbc:PostalZone>1600044</cbc:PostalZone>

<cbc:CountrySubentity>東京都</cbc:CountrySubentity>

<cac:AddressLine>

<cbc:Line>Third address line</cbc:Line>

</cac:AddressLine>

<cac:Country>

<cbc:IdentificationCode>JP</cbc:IdentificationCode> (4)

</cac:Country>

</cac:PostalAddress>

<cac:PartyLegalEntity>

<cbc:RegistrationName>株式会社 〇〇商事</cbc:RegistrationName> (7)

<cbc:CompanyID schemeID="0188">1234567890123</cbc:CompanyID> (8)

<cbc:CompanyLegalForm>Private Limited Company</cbc:CompanyLegalForm>

</cac:PartyLegalEntity>

<cac:Contact> (9)

<cbc:Name>青木 志郎</cbc:Name>

<cbc:Telephone>03-3xxx-0001</cbc:Telephone>

<cbc:ElectronicMail>shirou_aoki@〇〇co.jp</cbc:ElectronicMail>

</cac:Contact>

</cac:Party>

</cac:AccountingSupplierParty>| 1 | Seller electronic address (ibt-034), mandatory, the identification scheme identifier shall be chosen from the Electronic Address Scheme (EAS) list. |

| 2 | Seller identifier (ibt-029), if used, the identification scheme identifier shall be chosen from the entries of the list published by the ISO/IEC 6523 maintenance agency. |

| 3 | Sellers trading name (ibt-028). |

| 4 | Sellers country code (ibt-040). |

| 5 | An Invoice must not have the Seller tax identifier (ibt-031). |

| 6 | An Invoice must not have the Seller tax identifier (ibt-031), therefore, tax scheme for the sellers tax registration must not be binded. |

| 7 | Seller legal registrated name (ibt-027). |

| 8 | Seller legal registration identifier (ibt-030), if used, the identification scheme identifier shall be chosen from the entries of the list published by the ISO/IEC 6523 maintenance agency. |

| 9 | Seller contact (ibg-06). |

3.1.2. Buyer (AccountingCustomerParty)

Buyer is mandatory information and provided in element cac:AccountingCustomerParty

<cac:AccountingCustomerParty>

<cac:Party>

<cbc:EndpointID schemeID="0188">3210987654321</cbc:EndpointID> (1)

<cac:PartyIdentification>

<cbc:ID schemeID="0147">654321:000321:0147:1</cbc:ID> (2)

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>株式会社 〇〇物産</cbc:Name> (3)

</cac:PartyName>

<cac:PostalAddress>

<cbc:StreetName>北区</cbc:StreetName>

<cbc:AdditionalStreetName>北十二条西76-X</cbc:AdditionalStreetName>

<cbc:CityName>札幌市</cbc:CityName>

<cbc:PostalZone>0010012</cbc:PostalZone>

<cbc:CountrySubentity>北海道</cbc:CountrySubentity>

<cac:AddressLine>

<cbc:Line>Third line</cbc:Line>

</cac:AddressLine>

<cac:Country>

<cbc:IdentificationCode>JP</cbc:IdentificationCode> (4)

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID>T3210987654321</cbc:CompanyID> (5)

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> (6)

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>株式会社 〇〇物産</cbc:RegistrationName> (7)

<cbc:CompanyID schemeID="0147">654321:000321:0147:1</cbc:CompanyID> (8)

</cac:PartyLegalEntity>

<cac:Contact> (9)

<cbc:Name>株式会社 〇〇物産</cbc:Name>

<cbc:Telephone>011-757-1xxx</cbc:Telephone>

<cbc:ElectronicMail>purchaser@oobussan.co.jp</cbc:ElectronicMail>

</cac:Contact>

</cac:Party>

</cac:AccountingCustomerParty>| 1 | Buyer electronic address (ibt-049), mandatory, the identification scheme identifier shall be chosen from the Electronic Address Scheme (EAS) list. |

| 2 | Buyer identifier (ibt-046), if used, the identification scheme identifier shall be chosen from the entries of the list published by the ISO/IEC 6523 maintenance agency. |

| 3 | Buyer trading name (ibt-045). |

| 4 | Buyer country code (ibt-055), mandatory. |

| 5 | Buyer tax registration ID (ibt-048). |

| 6 | Tax scheme for the buyer tax registration. Use the appropriate code for the buyers jurisdiction, such as VAT or GST. |

| 7 | Buyer legal registered name (ibt-044). |

| 8 | Buyer legal registration identifier (ibt-047), if used, the identification scheme identifier shall be chosen from the entries of the list published by the ISO/IEC 6523 maintenance agency. |

| 9 | Buyer contact (ibg-09). |

3.1.3. Payment receiver (PayeeParty)

Payment receiver is optional information. If this information is not supplied, the seller is the payment receiver. When payee information is sent this is indicating that a factoring situation is being documented.

To reflect the assignment of an Invoice to a factor there is a need to:

-

have a disclaimer (notification notice) on the Invoice that the Invoice has been assigned to a factor. The disclaimer should be given using the Invoice note (IBT-22) on document level.

-

identify the Factor as the Payee

-

to have the bank account changed to favour of a Factor.

<cac:PayeeParty>

<cac:PartyIdentification>

<cbc:ID schemeID="0147">123456:000123:0147:1</cbc:ID>

(1)

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>Payee party</cbc:Name>

</cac:PartyName>

<cac:PartyLegalEntity>

<cbc:CompanyID schemeID="0147">123456:000123:0147:1</cbc:CompanyID>

(2)

</cac:PartyLegalEntity>

</cac:PayeeParty>| 1 | schemeID attribute is recommended for all party identifiers |

| 2 | schemeID attribute is recommended for party legal entity identifiers |

3.1.4. Sellers Tax Representative (TaxRepresentativePary)

Tax representative party for the seller is relevant for sellers delivering goods and services in a country without having a permanent establishment in that country. In such cases information on the tax representative shall be included in the invoice.

<cac:TaxRepresentativeParty>

<cac:PartyName>

<cbc:Name>TaxRepresentative Name</cbc:Name>

</cac:PartyName>

<cac:PostalAddress>

<cbc:StreetName>四谷4-32-X</cbc:StreetName>

<cbc:AdditionalStreetName>〇〇商事ビル</cbc:AdditionalStreetName>

<cbc:CityName>新宿区</cbc:CityName>

<cbc:PostalZone>1600044</cbc:PostalZone>

<cbc:CountrySubentity>東京都</cbc:CountrySubentity>

<cac:AddressLine>

<cbc:Line>Back door</cbc:Line>

</cac:AddressLine>

<cac:Country>

<cbc:IdentificationCode>JP</cbc:IdentificationCode>

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID>T7654321098765</cbc:CompanyID>

(1)

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:PartyTaxScheme>

</cac:TaxRepresentativeParty>| 1 | Tax identifier of seller tax representative (ibt-063) |

3.2. Delivery Details (Date and Location)

Delivery details may be given at document level.

Place and date of delivery is recommended, and should be sent unless this does not affect the ability to ensure the correctness of the invoice.

The delivery element contains information on name, address and delivery location identifier (cac:Delivery/cac:DeliveryLocation/cbc:ID) which may be used if the place of delivery is defined through an identifier. For example GLN (Global Location Number)issued by GS1.

<cac:Delivery>

<cbc:ActualDeliveryDate>2023-11-01</cbc:ActualDeliveryDate>

<cac:DeliveryLocation>

<cbc:ID schemeID="0147">123456:000123:0147:1</cbc:ID>

<cac:Address> (1)

<cbc:StreetName>北区</cbc:StreetName>

<cbc:AdditionalStreetName>北十二条西76-X</cbc:AdditionalStreetName>

<cbc:CityName>札幌市</cbc:CityName>

<cbc:PostalZone>0010012</cbc:PostalZone>

<cbc:CountrySubentity>北海道</CountrySubentity>

<cac:AddressLine>

<cbc:Line>Gate 15</cbc:Line>

</cac:AddressLine>

<cac:Country>

<cbc:IdentificationCode>JP</cbc:IdentificationCode> (2)

</cac:Country>

</cac:Address>

</cac:DeliveryLocation>

<cac:DeliveryParty> (3)

<cac:PartyName>

<cbc:Name>株式会社 〇〇物産 札幌支社</cbc:Name>

</cac:PartyName>

</cac:DeliveryParty>

</cac:Delivery>| 1 | Deliver to address (ibg-15), the address to which goods and services invoiced were or are delivered. |

| 2 | Deliver to country code (ibt-080), mandatory |

| 3 | Deliver to party name (ibt-070), the name of the party to which the goods and services are delivered. |

3.3. References and attachments

Support for invoice verification is a key function of an invoice. The invoice should provide sufficient information to look up relevant existing documentation, electronic or paper.

| Any reference element should contain valid information, if you do not have a reference, the element should not be present in the instance document. |

The invoice and credit note transactions supports the following references to existing documentation:

3.3.1. Purchase order and sales order reference

The purchase order is conditional. If order reference exist, use that, else use Buyer reference (see Buyer reference).

The customer will issue an order with a unique order number. This unique purchase order number should be supplied as the order reference on the invoice.

If order reference is stated at header level, the order reference element on line level can be used to state the order line numbers.

A sales order is issued by the seller, confirming the sale of specified products.

| In the invoice, both a purchase order and a sales order reference can be given, but be aware that an invoice instance cannot have a sales order reference, without the corresponding purchase order reference. |

<cac:OrderReference>

<cbc:ID>o-998877</cbc:ID> (1)

<cbc:SalesOrderID>so-12343</cbc:SalesOrderID> (2)

</cac:OrderReference>| 1 | Purchase order reference |

| 2 | Sales order reference |

3.3.2. Buyer reference

The buyer reference, known as Your ref, is conditional. An invoice shall have either the buyer reference or the order reference (see Purchase order and sales order reference)

The element is used for the reference of who ordered the products/services. Example being the name of the person ordering, employee number or a code identifying this person or department/group. Your ref is often used for internal routing at recipient, and hence it is important to fill this element with the correct values according to the need of the recipient.

If neither buyer reference nor a reference to an order is supplied by the customer, the name of the person ordering or appointed for the customer can be supplied in buyer reference if known by the supplier.

| When reference is provided by the customer, the correct element shall contain the provided reference. |

<cbc:BuyerReference>0150abc</cbc:BuyerReference>3.3.3. Invoiced object identifier

The invoiced object identifier is the identifier for an object on which the invoice is based, given by the Seller. Examples may be a subscription number, telephone number, meter point, vehicle, person etc., as applicable.

If it is not clear to the receiver what scheme is used for the identifier, a conditional scheme identifier should be used, that shall be chosen from the Invoiced object identifier scheme code list.

The invoiced object reference is provided by using the element cac:AdditionalDocumentReference with the document type code = 130

<cac:AdditionalDocumentReference>

<cbc:ID schemeID="ABT">DR35141</cbc:ID> (1) (2)

<cbc:DocumentTypeCode>130</cbc:DocumentTypeCode> (3)

</cac:AdditionalDocumentReference>| 1 | Invoice object identifier scheme is given as an attribute on the identifier. It states the type of the identifier according to code list UN/CEFACT 1153 |

| 2 | An identifier of an object that the invoice relates to. |

| 3 | A code that qualifies the identifier as an invoiced object identifiers. Document type code "130" qualifies that. |

3.3.4. Contract reference

To reference or match an invoice to a purchase contract, the contract number could be specified like this:

<cac:ContractDocumentReference>

<cbc:ID>framework no 1</cbc:ID>

</cac:ContractDocumentReference>3.3.5. Despatch and receipt advice references

Document level

To reference or match an invoice to a despatch or receipt advice use the following elements:

<cac:DespatchDocumentReference>

<cbc:ID>despadv-3</cbc:ID> (1)

</cac:DespatchDocumentReference>

<cac:ReceiptDocumentReference>

<cbc:ID>resadv-1</cbc:ID> (2)

</cac:ReceiptDocumentReference>| 1 | Despatch advice |

| 2 | Receipt advice |

Line level

When an invoice is charging items that have been delivered with separate dispatches the references should be provided on the line level as follows. When the invoiced quantity of an item has been delivered by more than one dispatch the invoice shall have separate lines for each dispatch. When dispatches are referenced on line level there shall not be a reference on document level.

<cac:DespatchLineReference>

<cac:DocumentReference>

<cbc:ID>despadv-3</cbc:ID> (1)

</cac:DocumentReference>

</cac:DespatchLineReference>| 1 | Despatch advice |

3.3.6. Tender reference

To identify the call for tender or lot the invoice relates to, use the 'OriginatorDocumentReference'. The identifier is, in most cases, the Procurement Procedure Identifier.

<cac:OriginatorDocumentReference>

<cbc:ID>ppid-123</cbc:ID>

</cac:OriginatorDocumentReference>3.3.7. Project reference

The project reference is optional to use, and is sent in an invoice in the element cac:ProjectReference/cbc:ID. In a credit note, this element does not exist, and project reference

is sent by using the element cac:AdditionalDocumentReference[cbc:DocumentTypeCode='50']/cbc:ID.

- NOTE

-

When sending the project reference, only the

cbc:IDand thecbc:DocumentTypeCodeare allowed in thecac:AdditionalDocumentReferenceelement.

<cac:ProjectReference>

<cbc:ID>project333</cbc:ID>

</cac:ProjectReference>3.3.8. Preceding invoice references

A credit note or negative invoice can refer to one or more initial invoice(s). This is done in the business group BG-3 Preceding invoice reference, providing the invoice number and issue date. The issue date shall be provided in case the preceding invoice reference is not unique.

In case correction applies to a large number of invoices, the invoicing period (BG-14), as necessary combined with a clarifying invoice note (IBT-22), may instead be given at document level.

3.3.9. Attachments

An invoice may contain a supportive document as informative. Examples of such documents may be work reports, certificates or other documents that relate to the purchase or the invoiced items. A supportive document can be attached to the invoice in two ways: by providing a direct hyperlink through which the document can be downloaded or by embedding the document into the invoice. A compliant receiver is required to be able to receive an attached supportive document and, in case of embedded files, to convert it into a file but he is not required to handle the content of that file since it is only provided as informative.

When attaching a document using an uri the hyperlink shall point directly to the file that is to be downloaded.

An embedded document is contained in the invoice as binary object using base64 encoding and shall be supplemented with information about the name of the document file and a mime code indicating the type of the file. This allows the receiver to convert the binary code into a file that has the same name as the original file and allows him to associate the received file to a suitable application for viewing its content. The set of allowed codes for the file type (mime code) is limited to types that can be opened with applications that are commonly used and available.

As is with other file types, when an attached file is an XML file the receiver is expected to be able to receive and convert the binary object into an XML file but the sender can not expect the receiver to view or process the content of that XML file. Any further handling of an embedded XML file attachment is optional for the receiver.

<cac:AdditionalDocumentReference>

<cbc:ID>ts12345</cbc:ID> (1)

<cbc:DocumentDescription>Technical specification</cbc:DocumentDescription> (2)

<cac:Attachment>

<cac:ExternalReference>

<cbc:URI>www.techspec.no</cbc:URI> (3)

</cac:ExternalReference>

</cac:Attachment>

</cac:AdditionalDocumentReference><cac:AdditionalDocumentReference>

<cbc:ID>mr4343</cbc:ID> (1)

<cbc:DocumentDescription>milage report</cbc:DocumentDescription> (2)

<cac:Attachment>

<cbc:EmbeddedDocumentBinaryObject mimeCode="text/csv" filename="milage.csv"

>bWlsYWdlIHJlcG9ydA==</cbc:EmbeddedDocumentBinaryObject> (4)

</cac:Attachment>

</cac:AdditionalDocumentReference>-

An identifier of the supporting document (ibt-122)

-

A description of the supporting document (ibt-123)

-

The URL (Uniform Resource Locator) that identifies where the external document is located (ibt-124)

-

An attached document embedded as binary object or sent together with the invoice. (ibt-125). The file type is given with the attribute "mimeCode" (ibt-125-1) and the name of the original file is given in the attribute "filename" (ibt-125-2).

3.3.10. Reference to delivery note

In Summarised invoicing process, the supplier sends a Delivery Note to the customer with each delivery and the buyer uses the information in the Delivery Note to verify the reception of the items. The Delivery Note is focused on providing information about the items that are being delivered. At the end of a period (usually a month) the supplier sends an invoice that summarises the items that were delivered during that period.

To reference or match an invoice to a despatch or receipt advice use the following elements:

<cac:InvoiceLine>

<cbc:ID>1</cbc:ID>

<cbc:InvoicedQuantity unitCode="H87">5</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="JPY">250000</cbc:LineExtensionAmount>

<cac:DocumentReference>

<cbc:ID>D001-1</cbc:ID><!--1-->

</cac:DocumentReference>

<cac:Item>

<cbc:Name>デスクチェア</cbc:Name>

<cac:ClassifiedTaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>10</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

</cac:Item>

<cac:Price>

<cbc:PriceAmount currencyID="JPY">50000</cbc:PriceAmount>

<cbc:BaseQuantity unitCode="H87">1</cbc:BaseQuantity>

</cac:Price>

</cac:InvoiceLine>

<cac:InvoiceLine>

<cbc:ID>2</cbc:ID>

<cbc:InvoicedQuantity unitCode="H87">5</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="JPY">25000</cbc:LineExtensionAmount>

<cac:DocumentReference>

<cbc:ID>D001-2</cbc:ID><!--1-->

</cac:DocumentReference>

<cac:Item>

<cbc:Name>コピー用紙(A4)</cbc:Name>

<cac:ClassifiedTaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>10</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

</cac:Item>

<cac:Price>

<cbc:PriceAmount currencyID="JPY">5000</cbc:PriceAmount>

<cbc:BaseQuantity unitCode="H87">1</cbc:BaseQuantity>

</cac:Price>

</cac:InvoiceLine> | 1 | Delivery note number |

<cac:InvoiceLine>

<cbc:ID>1</cbc:ID>

<cbc:InvoicedQuantity unitCode="H87">1</cbc:InvoicedQuantity>(1)

<cbc:LineExtensionAmount currencyID="JPY">275000</cbc:LineExtensionAmount>

<cac:Item>

<cbc:Name>D001</cbc:Name>(2)

<cac:ClassifiedTaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>10</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

</cac:Item>

<cac:Price>

<cbc:PriceAmount currencyID="JPY">275000</cbc:PriceAmount><!--3-->

<cbc:BaseQuantity unitCode="H87">1</cbc:BaseQuantity>

</cac:Price>

</cac:InvoiceLine> | 1 | Invoiced quantity is 1. |

| 2 | Delivery note number |

| 3 | Item net price shall equal to the total taxable amount stated on the Delivery Note. |

3.4. Allowances and Charges

The Invoice and credit note transactions has elements for Allowance/charge on 3 levels.

The element cac:AllowanceCharge with sub element cbc:ChargeIndicator indicates whether the instance is a charge (true) or an allowance (false).

- The header level

-

Applies to the whole invoice and is included in the calculation of the invoice total amount.

-

Several allowances and charges may be supplied

-

Specification of TAX for allowances and charges,

cac:TaxCategorywith sub elements, shall be supplied -

The sum of all allowances and charges on the header level shall be specified in

cbc:AllowanceTotalAmountandcbc:ChargeTotalAmountrespectively.

-

- The line level

-

Applies to the line level and is included in the calculation of the line amount.

-

Several allowances and charges may be supplied

-

Specification of TAX for allowances and charges shall not be specified, as the TAX category stated for the invoice line itself, applies also to the allowances or charges of that line.

-

The sum of all allowances and charges on the line level shall be taken into account, subtracted or added, when calculating the line extension amount . These line level allowances and charges shall not be calculated into the header level elements.

-

- The line level Price element

-

A way to inform the buyer how the price is set. Is also relevant if the seller or buyer want to post the allowance in their accounting systems. The price itself shall always be the net price, i.e. the base amount reduced with a discount (allowance).

-

Only one occurrence of allowance (discount) is allowed.

-

Specification of TAX for allowance shall not be specified

-

Allowance related to Price shall not be part of any other calculations.

-

Allowance related to Price may specify amount and the base amount.

-

<cac:AllowanceCharge>

<cbc:ChargeIndicator>true</cbc:ChargeIndicator> (1)

<cbc:AllowanceChargeReasonCode>FC</cbc:AllowanceChargeReasonCode>

<cbc:AllowanceChargeReason>Freight service</cbc:AllowanceChargeReason>

<cbc:MultiplierFactorNumeric>2</cbc:MultiplierFactorNumeric> (4)

<cbc:Amount currencyID="JPY">20</cbc:Amount> (5)

<cbc:BaseAmount currencyID="JPY">1000</cbc:BaseAmount> (3)

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>10</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:AllowanceCharge>

<cac:AllowanceCharge>

<cbc:ChargeIndicator>false</cbc:ChargeIndicator> (2)

<cbc:AllowanceChargeReasonCode>65</cbc:AllowanceChargeReasonCode>

<cbc:AllowanceChargeReason>Production error discount</cbc:AllowanceChargeReason>

<cbc:Amount currencyID="JPY">10</cbc:Amount>

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>10</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:AllowanceCharge>| 1 | ChargeIndicator = true to indicate a charge |

| 2 | ChargeIndicator = false to indicate an allowance |

| 3 | Base amount, to be used with the percentage to calculate the amount |

| 4 | Charge percentage |

| 5 | \$"Amount" = "Base amount" times ("Percentage" div 100)\$ |

<cac:InvoiceLine>

<!-- Code omitted for clarity -->

<cac:AllowanceCharge>

<cbc:ChargeIndicator>true</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>CG</cbc:AllowanceChargeReasonCode>

<cbc:AllowanceChargeReason>Cleaning</cbc:AllowanceChargeReason>

<cbc:MultiplierFactorNumeric>10</cbc:MultiplierFactorNumeric>

<cbc:Amount currencyID="JPY">1</cbc:Amount>

<cbc:BaseAmount currencyID="JPY">10</cbc:BaseAmount>

</cac:AllowanceCharge>

<cac:AllowanceCharge>

<cbc:ChargeIndicator>false</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>95</cbc:AllowanceChargeReasonCode>

<cbc:AllowanceChargeReason>Discount</cbc:AllowanceChargeReason>

<cbc:Amount currencyID="JPY">101</cbc:Amount>

</cac:AllowanceCharge>3.5. Payment means information

3.5.1. Credit transfer

| Payment means code 30 as defined below shall be supported by all receivers of a PINT compliant invoice. This payment method acts as the common denominator for global trade. |

If payment is made by credit transfer, the Payment account identifier (IBT-84) is mandatory

Examples of codes for payment by credit transfer are:

-

30 - Credit transfer

<cac:PaymentMeans>

<cbc:PaymentMeansCode name="Credit transfer">30</cbc:PaymentMeansCode>(1)

<cbc:PaymentID>93274234</cbc:PaymentID>(2)

<cac:PayeeFinancialAccount>

<cbc:ID>32423940</cbc:ID>(3)

<cbc:Name>AccountName</cbc:Name>

<cac:FinancialInstitutionBranch>

<cbc:ID>BIC32409</cbc:ID>(4)

</cac:FinancialInstitutionBranch>

</cac:PayeeFinancialAccount>

</cac:PaymentMeans>| 1 | Mandatory, payment means code for credit transfer |

| 2 | Remittance information |

| 3 | Mandatory, IBAN (in case of a SEPA payment) or a national account number (BBAN) |

| 4 | BIC or a national clearing code |

3.5.2. Card Payment

If the Buyer had opted to pay by using a payment card such as a credit or debit card, information on the Primary Account Number (PAN) shall be present in the invoice.

Examples of codes for payment by card are:

-

48 - Bank card

-

54 - Credit card

-

55 - Debit card

<cac:PaymentMeans>

<cbc:PaymentMeansCode name="Credit card">54</cbc:PaymentMeansCode>(1)

<cbc:PaymentID>9387439</cbc:PaymentID>

<cac:CardAccount>

<cbc:PrimaryAccountNumberID>123236</cbc:PrimaryAccountNumberID>(2)

<cbc:NetworkID>VISA</cbc:NetworkID>(3)

<cbc:HolderName>Card holders name</cbc:HolderName>(4)

</cac:CardAccount>

</cac:PaymentMeans>| 1 | Payment means code for credit card |

| 2 | Mandatory, shall be the last 4 to 6 digits of the payment card number |

| 3 | Mandatory, used to identify the financial service network provider of the card. Examples are VISA, MasterCard, American Express. |

| 4 | Card holder name |

3.5.3. Payment means Usage in Japan

ZENGIN credit transfer

If payment is made by ZENGIN credit transfer, the Payment account identifier (IBT-084) is mandatory.

<cac:PaymentMeans>

<cbc:PaymentMeansCode name="Credit transfer">30</cbc:PaymentMeansCode>(1)

<cac:PayeeFinancialAccount>

<cbc:ID>1234:567:1:3242394</cbc:ID>(2)

<cbc:Name>カ)マルマルシヨウジ</cbc:Name>(3)

</cac:PayeeFinancialAccount>

</cac:PaymentMeans>| 1 | Mandatory, payment means code for credit transfer |

| 2 | Payee’s bank number, bank branch number, bank account type, bank account number |

| 3 | Account holder’s name of Payee’s bank account |

3.6. Item information

3.6.1. Item identifiers

In an invoice line the seller item identifier, the buyer item identifier and the standard item identifier can be provided. For sellers and buyers item identifiers, no scheme attribute is used, whilst the schemeID

is mandatory for the standard item identification, and must be from the ISO 6523 ICD list.

<cac:BuyersItemIdentification>

<cbc:ID>b-13214</cbc:ID>

</cac:BuyersItemIdentification>

<cac:SellersItemIdentification>

<cbc:ID>97iugug876</cbc:ID>

</cac:SellersItemIdentification>

<cac:StandardItemIdentification>

<cbc:ID schemeID="0160">4503994155481</cbc:ID> (1)

</cac:StandardItemIdentification>| 1 | 0160 is the ICD value for a GTIN identifier |

3.6.2. Item classification

Several different item classification codes can be provided per invoice line, and the codes must be from one of the classification schemes in code list UNCL7143.

<cac:CommodityClassification>

<cbc:ItemClassificationCode listID="STI">09348023</cbc:ItemClassificationCode>(1)

</cac:CommodityClassification>| 1 | listID must be from UNCL7143 code list, and code STI indicates this is a CPV classification. |

<cac:CommodityClassification>

<cbc:ItemClassificationCode listID="TST" listVersionID="19.05.01">86776</cbc:ItemClassificationCode>(1)

</cac:CommodityClassification>| 1 | listID must be from UNCL7143 code list, and code TST indicates this is a UNSPSC classification, listVersionID is optional, but can be used to specify the version of UNSPSC. NOTE, in previous versions code MP was used as temporary workaround to identify UNSPSC. In fall release 2019 it is replaced with the new 7143 code TST that is specific for UNSPSC. |

3.7. Price information

An invoice must contain information about the item net price and additional information such as gross price, item price base quantity and price discount may be added.

For details on calculating price see Item net price (IBT-146).

<cac:Price>

<cbc:PriceAmount currencyID="JPY">4000</cbc:PriceAmount> (4)

<cbc:BaseQuantity unitCode="H87">1</cbc:BaseQuantity> (3)

<cac:AllowanceCharge>

<cbc:ChargeIndicator>false</cbc:ChargeIndicator>

<cbc:Amount currencyID="JPY">1000</cbc:Amount> (2)

<cbc:BaseAmount currencyID="JPY">5000</cbc:BaseAmount> (1)

</cac:AllowanceCharge>

</cac:Price>| 1 | Item gross price |

| 2 | Item price discount |

| 3 | Item price base quantity |

| 4 | Item net price, must be equal to Item Gross price - item price discount (if these elements are used) |

<cac:Price>

<cbc:PriceAmount currencyID="JPY">40000</cbc:PriceAmount>

<cbc:BaseQuantity unitCode="H87">1</cbc:BaseQuantity>

</cac:Price>3.8. Unit of measure

Unit of measure in an invoice allows the use of codes from UNECE Recommendation No. 20 (version 11e), as well as codes from UNECE Recommendation No. 21 prefixed with an X.

| Code | Name |

|---|---|

H87 |

Piece |

KGM |

Kilogram |

MTR |

Meter |

LTR |

Litre |

MTK |

Square metre |

MTQ |

Cubic metre |

KTM |

Kilometre |

TNE |

Tonne (metric ton) |

KWH |

Kilowatt hour |

DAY |

Day |

HUR |

Hour |

MIN |

Minute |

| Code | Name |

|---|---|

XBG |

Bag |

XBX |

Box |

XCT |

Carton |

XCY |

Cylinder |

XBA |

Barrel |

XPK |

Package |

XPX |

Pallet |

XRL |

Reel |

XSA |

Sack |

XST |

Sheet |

<cbc:InvoicedQuantity unitCode="H87">10</cbc:InvoicedQuantity> (1)

<cbc:InvoicedQuantity unitCode="XPX">10</cbc:InvoicedQuantity> (2)| 1 | Code H87 from Recommendation no. 20 |

| 2 | Code PX, prefixed with an X from Recommendation no. 21 |

4. Tax information

Following sections given information on how the tax is applied in the relevant jurisdiction.

4.1. Consumption Tax in Japan

*This Chapter is written and edited by Japan Peppol Authority (Hiroyuki Kato).

4.1.1. Overview of Consumption Tax system in Japan

Consumption Tax in Japan is a broad-based tax levied on nearly all supplies of goods and services in Japan. In other countries, Consumption Tax is known as the Value Added Tax (VAT) or Goods and Services Tax (GST). Consumption Tax in Japan is almost same as VAT in EU countries and GST.

4.1.2. Consumption Tax rates in Japan

There are two rates. One is standard rate (10%) and the other is reduced rate (8%). The reduced rate has been implemented from October 2019. Its scope is limited. Only transactions of foods and beverages (excluding liquors) and subscribed newspapers issued twice or more per week are covered by the reduced rate.

4.1.3. Taxable business and Exempt Business

A taxpayer of Consumption Tax is a business. A business with taxable sales of more than 10 million JPY (during the reference taxable period)* shall be categorized as a taxable business. On the other hands, there is a special measure for SMEs. A business with taxable sales of 10 million JPY or under shall be exempt from Consumption Tax (an exempt business).

*The “during the reference period” is the year or business year before the previous one.

4.1.4. Current Input Tax credit system

Under the current system, in Japan, Invoice Based method has not adopted for input tax credit purpose. To claim of input tax, in principle, a taxable business is required to retain an accounting book and a Document issued by a supplier with specific description.

The Document can be issued by not only a taxable business but also an exempt business. So, under the current system, even a taxable transaction with an exempt business would be subject to input tax credit.

The Document must contain the following information.

-

Name of Supplier

-

Date of taxable transaction

-

Description of taxable transaction ※If the taxable transaction is subject to the reduced tax rate, a statement clarifying this must be included.

-

Taxable amount per tax rate

-

Name of Buyer

This specification may support the Document.

4.1.5. New Input Tax credit system (Qualified Invoice Base method)

On October 1st, 2023, the current input tax credit system will be changed. “Qualified Invoice Base method”, new input tax credit system, will be implemented. It is almost same as Invoice Based method in other countries.

Under the new method, a taxable business shall retain an accounting book with certain descriptions and a Qualified Invoice issued by a registered taxable business. A Qualified Invoice can be issued only by a registered taxable business. This means that a taxable business without the registration and an exempt business can’t issue a Qualified Invoice. So that, a taxable transaction with them is not subject to input tax credit.

From October 1st, 2023 to September 30th, 2029, the transitional rule will be applicable. Under the transitional rule, a taxable business can recover a certain percentage of input tax paid on a taxable transaction with a non-registered taxable business or an exempt business by retaining the Document (same as the document under the current system) and an accounting book.

Table 1 Difference of requirements to apply input tax credit

Current System (~September 30th 2023) |

Qualified Invoice Based method (October 1st 2023~) |

Accounting Book with specific description |

Accounting Book with specific description |

Document issued by a supplier with specific description |

(Principle) A Qualified Invoice (*Transitional rule) Document issued by a supplier with specific description |

Table 2 Difference of Information required on a Non-tax Invoice (the Document) and a Qualified Invoice

| Invoice | A Non-tax Invoice (the Document) | A Qualified Invoice |

|---|---|---|

Name of Supplier |

〇 |

〇 |

Supplier’s Registration number for Qualified Invoice purpose |

× |

〇 |

Date of taxable transaction |

〇 |

〇 |

Description of taxable transaction ※If the taxable transaction is subject to the reduced tax rate, a statement clarifying this must be included. |

〇 |

〇 |

Taxable amount per tax rate |

〇 |

〇 |

Tax amount per tax rate |

× |

〇 |

Tax rate |

× |

〇 |

Name of buyer |

〇 |

〇 |

4.1.6. Correction of the preceding Non-tax Invoice

An exempt business that wants to correct an error may issue a new Non-tax Invoice to rectify the preceding one.

4.1.7. Invoice examples

Example 1, Semantic contents of a Non-tax Invoice

Information required on a Non-tax Invoice (480) can be stated in semantic model as follows.

| Information required on Qualified Invoice | ID (Semantic Model) |

|---|---|

Name of Supplier |

ibt-027 |

Date of taxable transaction |

ibg-14 (ibt-073 and ibt-074) Ibg-26 (ibt-134 and ibt-135) |

Description of taxable transaction ※If the taxable transaction is subject to the reduced tax rate, a statement clarifying this must be included. |

ibt-153 |

Taxable amount per tax rate |

ibt-116 |

Tax rate |

ibt-118 and ibt-119 |

Name of buyer |

ibt-044 |

Example 2, Summarised Invoice 1

Line document reference (ibt-188) may be used in order to refer the Delivery Note.

| Group | Business term | Term ID | Example value |

|---|---|---|---|

SELLER |

ibg-04 |

||

Seller name |

ibt-027 |

A corporation |

|

BUYER |

ibg-07 |

||

Buyer name |

ibt-044 |

B Corporation |

|

TAX BREAK DOWN |

ibg-23 |

||

Tax category taxable amount |

ibt-116 |

10000 |

|

Tax category tax amount |

ibt-117 |

0 |

|

Tax category code |

ibt-118 |

S |

|

Tax category tax rate |

ibt-119 |

10 |

|

INVOICE LINE |

ibg-25 |

||

Invoiced quantity |

ibt-129 |

5 |

|

Invoiced quantity unit of measure code |

ibt-130 |

H87 |

|

Invoice line net amount |

ibt-131 |

10000 |

|

INVOICE LINE PERIOD |

ibg-26 |

||

Invoice line period start date |

ibt-134 |

2023-10-31 |

|

Invoice line period end date |

ibt-135 |

2023-10-31 |

|

PRICE DETAILS |

ibg-29 |

||

Item net price |

ibt-146 |

2000 |

|

Item price discount |

ibt-147 |

0 |

|

Item gross price |

ibt-148 |

2000 |

|

Item price base quantity |

ibt-149 |

1 |

|

LINE TAX INFORMATION |

ibg-30 |

||

Invoiced item Tax category code |

ibt-151 |

S |

|

Invoiced item Tax rate |

ibt-152 |

10 |

|

ITEM INFORMATION |

ibg-31 |

||

Item name |

ibt-153 |

Goods |

|

LINE DOCUMENT REFERENCE |

ibg-36 |

||

Invoice line document identifier |

ibt-188 |

D001 |

Example 3, Summarised Invoice 2

Information of the Delivery Note can be stated in Item name (ibt-153).

So, the description of the Delivery Note number is not satisfied with the legal requirement as a Non-tax Invoice and the buyer who receives this type of invoice (summarised invoice) shall retain both that invoice and the Delivery Note to meet the requirement for input tax credit purpose.

| Group | Business term | Term ID | Example value |

|---|---|---|---|

SELLER |

ibg-04 |

||

Seller name |

ibt-027 |

A corporation |

|

BUYER |

ibg-07 |

||

Buyer name |

ibt-044 |

B Corporation |

|

TAX BREAK DOWN |

ibg-23 |

||

Tax category taxable amount |

ibt-116 |

10000 |

|

Tax category tax amount |

ibt-117 |

0 |

|

Tax category code |

ibt-118 |

S |

|

Tax category tax rate |

ibt-119 |

10 |

|

INVOICE LINE |

ibg-25 |

||

Invoiced quantity |

ibt-129 |

1 |

|

Invoiced quantity unit of measure code |

ibt-130 |

H87 |

|

Invoice line net amount |

ibt-131 |

10000 |

|

INVOICE LINE PERIOD |

ibg-26 |

||

Invoice line period start date |

ibt-134 |

2023-10-31 |

|

Invoice line period end date |

ibt-135 |

2023-10-31 |

|

PRICE DETAILS |

ibg-29 |

||

Item net price |

ibt-146 |

10000 |

|

Item price discount |

ibt-147 |

0 |

|

Item gross price |

ibt-148 |

10000 |

|

Item price base quantity |

ibt-149 |

1 |

|

LINE TAX INFORMATION |

ibg-30 |

||

Invoiced item Tax category code |

ibt-151 |

S |

|

Invoiced item Tax rate |

ibt-152 |

10 |

|

ITEM INFORMATION |

ibg-31 |

||

Item name |

ibt-153 |

D001 |

Item net price shall equal to the total taxable amount stated on the Delivery Note.

Example 4 A Non-tax Invoice with allowance

This is a case where one Non-tax Invoice which contains both invoicing line and allowance line (In this case, the taxable amount is reduced directly.)

| Group | Business term | Term ID | Example value |

|---|---|---|---|

SELLER |

ibg-04 |

||

Seller name |

ibt-027 |

A corporation |

|

BUYER |

ibg-07 |

||

Buyer name |

ibt-044 |

B Corporation |

|

TAX BREAK DOWN |

ibg-23 |

||

Tax category taxable amount |

ibt-116 |

50 |

|

Tax category tax amount |

ibt-117 |

0 |

|

Tax category code |

ibt-118 |

S |

|

Tax category tax rate |

ibt-119 |

10 |

|

INVOICE LINE |

ibg-25 |

||

Invoiced quantity |

ibt-129 |

1 |

|

Invoiced quantity unit of measure code |

ibt-130 |

H87 |

|

Invoice line net amount |

ibt-131 |

50 |

|

INVOICE LINE PERIOD |

ibg-26 |

||

Invoice line period start date |

ibt-134 |

2023-10-31 |

|

Invoice line period end date |

ibt-135 |

2023-10-31 |

|

INVOICE LINE ALLOWANCES |

ibg-27 |

||

Invoice line allowance amount |

ibt-136 |

150 |

|

Invoice line allowance base amount |

ibt-137 |

||

Invoice line allowance percentage |

ibt-138 |

||

PRICE DETAILS |

ibg-29 |

||

Item net price |

ibt-146 |

200 |

|

Item price discount |

ibt-147 |

0 |

|

Item gross price |

ibt-148 |

200 |

|

Item price base quantity |

ibt-149 |

1 |

|

LINE TAX INFORMATION |

ibg-30 |

||

Invoiced item Tax category code |

ibt-151 |

S |

|

Invoiced item Tax rate |

ibt-152 |

10 |

|

ITEM INFORMATION |

ibg-31 |

||

Item name |

ibt-153 |

Goods |

Example 5, A Non-tax Invoice to correct a mistake on the preceding one

Even though there are some ways to correct a mistake on the preceding Non-tax Invoice, only the way to rectify the preceding one is supported.

In this case, the Non-tax Invoice (480) is used and in practice, to refer the preceding one, Preceding invoice reference (ibg-03) may be used.

So, a buyer who receives a Non-tax Invoice with the reference to the preceding one shall process it as the Non-tax Invoice to correct a mistake on the preceding one.

A Non-tax Invoice issued to correct a mistake on the preceding one.

| Group | Business term | Term ID | Example value |

|---|---|---|---|

PRECEDING INVOICE REFERENCE |

ibg-03 |

||

Preceding Invoice reference |

ibt-025 |

123456 |

|

Preceding Invoice issue date |

ibt-026 |

2023-10-15 |

|

SELLER |

ibg-04 |

||

Seller name |

ibt-027 |

A corporation |

|

BUYER |

ibg-07 |

||

Buyer name |

ibt-044 |

B Corporation |

|

TAX BREAK DOWN |

ibg-23 |

||

Tax category taxable amount |

ibt-116 |

10000 |

|

Tax category tax amount |

ibt-117 |

0 |

|

Tax category code |

ibt-118 |

S |

|

Tax category tax rate |

ibt-119 |

10 |

|

INVOICE LINE |

ibg-25 |

||

Invoiced quantity |

ibt-129 |

5 |

|

Invoiced quantity unit of measure code |

ibt-130 |

H87 |

|

Invoice line net amount |

ibt-131 |

10000 |

|

INVOICE LINE PERIOD |

ibg-26 |

||

Invoice line period start date |

ibt-134 |

2023-10-31 |

|

Invoice line period end date |

ibt-135 |

2023-10-31 |

|

PRICE DETAILS |

ibg-29 |

||

Item net price |

ibt-146 |

2000 |

|

Item price discount |

ibt-147 |

0 |

|

Item gross price |

ibt-148 |

2000 |

|

Item price base quantity |

ibt-149 |

1 |

|

LINE TAX INFORMATION |

ibg-30 |

||

Invoiced item Tax category code |

ibt-151 |

S |

|

Invoiced item Tax rate |

ibt-152 |

10 |

|

ITEM INFORMATION |

ibg-31 |

||

Item name |

ibt-153 |

Goods |

5. Rules

The information given in a PINT invoice must comply to a set of rules on the content of the business terms as well as the relationship between them.

5.1. Calculations

5.1.1. Calculation of totals

Formulas for the calculations of totals are as follows:

| Business term id | Term name | Calculation |

|---|---|---|

IBT-106 |

Sum of invoice line net amounts |

\$sum("IBT-131: Invoice line net amount")\$ |

IBT-107 |

Sum of allowances on document level |

\$sum("IBT-92: Document level allowance amount")\$ |

IBT-108 |

Sum of charges on document level |

\$sum("IBT-99: Document level charge amount")\$ |

IBT-109 |

Invoice total amount without CT |

\$\ \ \ \ "IBT-106: Sum of invoice line net amounts"\$ |

IBT-110 |

Invoice total CT amount |

\$sum("IBT-117: CT category tax amount")\$ |

IBT-112 |

Invoice total amount with CT |

\$\ \ \ \ "IBT-109: Invoice total amount without CT"\$ |

IBT-115 |

Amount due for payment |

\$\ \ \ \ "IBT-112: Invoice total amount with CT"\$ |

5.1.2. UBL syntax calculation formulas

The following elements show the legal monetary totals for an invoice or credit note

| Element | Formula |

|---|---|

<cbc:LineExtensionAmount> |

\$sum("cac:InvoiceLine/cbc:LineExtensionAmount")\$ |

<cbc:AllowanceTotalAmount> |

\$sum("cac:AllowanceCharge[ChargeIndicator='false']/cbc:Amount")\$ |

<cbc:ChargeTotalAmount> |

\$sum("cac:AllowanceCharge[ChargeIndicator='true']/cbc:Amount")\$ |

<cbc:TaxExclusiveAmount> |

\$\ \ \ \ "cac:LegalMonetaryTotal/cbc:LineExtensionAmount"\$ |

<cbc:TaxInclusiveAmount> |

\$\ \ \ \ "cac:LegalMonetaryTotal/cbc:TaxExclusiveAmount"\$ |

<cbc:PrepaidAmount> |

Not applicable |

<cbc:PayableRoundingAmount> |

Not applicable |

<cbc:PayableAmount> |

\$\ \ \ \ "cac:LegalMonetaryTotal/cbc:TaxInclusiveAmount"\$ |

Element for rounding amount, the PayableRoundingAmount

It is possible to round the expected payable amount.

The element cac:LegalMonetaryTotal/cbc:PayableRoundingAmount is used for this purpose and is specified on the header level. This value shall be added to the value in cac:LegalMonetaryTotal/cbc:PayableAmount.

Example: Amount 999.81 rounded to 1000. PayableRounding Amount = 0.19

5.1.3. Calculation on line level

Item net price (IBT-146)

If gross price and discount exist, the Item net price has to equal with the item gross price less the item price discount.

Calculation formula:

\$"Item net price" = "Item gross price (IBT-148)" - "Item price discount (IBT-147)"\$

<cac:Price>

<cbc:PriceAmount currencyID="JPY">410</cbc:PriceAmount>(3)

<cbc:BaseQuantity unitCode="C62">1</cbc:BaseQuantity>

<cac:AllowanceCharge>

<cbc:ChargeIndicator>false</cbc:ChargeIndicator>

<cbc:Amount currencyID="JPY">40</cbc:Amount>(2)

<cbc:BaseAmount currencyID="JPY">450</cbc:BaseAmount>(1)

</cac:AllowanceCharge>

</cac:Price>| 1 | Item gross price |

| 2 | Item price discount |

| 3 | \$"Item price net amount" = "Item gross price" - "Item price discount"\$ |

Invoice line net amount (IBT-131)

The invoice line net amount (IBT-131) is as the name implies the net amount without CT, and inclusive of line level allowance and charges.

The formula for calculating the invoice line net amount is:

\$"Item line net amount" = (("Item net price (IBT-146)" div "Item price base quantity (IBT-149)")\$

\$times ("Invoiced Quantity (IBT-129)")\$

\$+ "Invoice line charge amount (IBT-141)" - "Invoice line allowance amount (IBT-136)"\$

|

If the line net amount must be rounded to maximum decimals, please note that the different parts of the calculation must be rounded separately. I.e the result of: \$"Item line net amount" = (("Item net price (IBT-146)" div "Item price base quantity (IBT-149)") times ("Invoiced Quantity (IBT-129)")\$ must be rounded to maximum decimals, and the allowance/charge amounts are also rounded separately. |

<cbc:InvoicedQuantity unitCode="C62">10</cbc:InvoicedQuantity>(3)

<cbc:LineExtensionAmount currencyID="JPY">1000</cbc:LineExtensionAmount>(4)

<!-- Code omitted for clarity-->

<cac:Price>

<cbc:PriceAmount currencyID="JPY">200</cbc:PriceAmount>(1)

<cbc:BaseQuantity unitCode="C62">2</cbc:BaseQuantity>(2)

</cac:Price>| 1 | Item net price |

| 2 | Item price base quantity |

| 3 | Invoiced quantity |

| 4 | \$"Invoice line net amount" = (("Item net price" div "Item price base quantity") times ("Invoiced Quantity")\$ |

<cbc:InvoicedQuantity unitCode="C62">10</cbc:InvoicedQuantity>(4)

<cbc:LineExtensionAmount currencyID="JPY">900</cbc:LineExtensionAmount>(5)

<!-- Code omitted for clarity-->

<cac:AllowanceCharge>

<cbc:ChargeIndicator>true</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>CG</cbc:AllowanceChargeReasonCode>

<cbc:AllowanceChargeReason>Charge</cbc:AllowanceChargeReason>

<cbc:MultiplierFactorNumeric>1</cbc:MultiplierFactorNumeric>

<cbc:Amount currencyID="JPY">1</cbc:Amount>(2)

<cbc:BaseAmount currencyID="JPY">100</cbc:BaseAmount>

</cac:AllowanceCharge>

<cac:AllowanceCharge>

<cbc:ChargeIndicator>false</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>95</cbc:AllowanceChargeReasonCode>

<cbc:AllowanceChargeReason>Discount</cbc:AllowanceChargeReason>

<cbc:Amount currencyID="JPY">101</cbc:Amount>(3)

</cac:AllowanceCharge>

<!-- Code omitted for clarity-->

<cac:Price>

<cbc:PriceAmount currencyID="JPY">100</cbc:PriceAmount>(1)

<cbc:BaseQuantity unitCode="C62">1</cbc:BaseQuantity>

</cac:Price>| 1 | Item net price |

| 2 | Line charge amounts |

| 3 | Line allowance amount |

| 4 | Invoiced quantity |

| 5 | \$"Invoice line net amount" = ("Item net price" times "Invoiced Quantity") + "line charge amount" - "line allowance amount"\$ |

5.1.4. Calculation of allowance/charge amount

Allowance and charge on document- and line level consists of elements carrying information on the allowance/charge base amount and the allowance/charge percentage. These are, if present in the invoice instance, used for calculating the allowance/charge amount.

If base amount is present, the percentage shall also be present, and if percentage is present, the base amount shall also be present, and the calculation of the amount shall be:

\$"Amount" = "Base amount" times ("Percentage" div 100)\$

<cac:AllowanceCharge>

<cbc:ChargeIndicator>true</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>CG</cbc:AllowanceChargeReasonCode>

<cbc:AllowanceChargeReason>Cleaning</cbc:AllowanceChargeReason>

<cbc:MultiplierFactorNumeric>20</cbc:MultiplierFactorNumeric>(2)

<cbc:Amount currencyID="JPY">200</cbc:Amount> (3)

<cbc:BaseAmount currencyID="JPY">1000</cbc:BaseAmount>(1)

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>10</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:AllowanceCharge>| 1 | Base amount, to be used with the percentage to calculate the amount |

| 2 | Charge percentage |

| 3 | \$"Base amount" times ("Percentage" div 100) = "Amount"\$ |

<cac:AllowanceCharge>

<cbc:ChargeIndicator>false</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>95</cbc:AllowanceChargeReasonCode>

<cbc:AllowanceChargeReason>Discount</cbc:AllowanceChargeReason>

<cbc:Amount currencyID="JPY">100</cbc:Amount>(1)

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>10</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:AllowanceCharge>| 1 | Amount of allowance without calculations based on base amount and percentage |

5.2. Rounding

5.2.1. Shared rounding rules

A maximum of two digits are allowed for the following amounts in an invoice.

-

Document level allowance amount (ibt-092)

-

Document level charge amount (ibt-099)

-

Sum of allowances on document level (ibt-107)

-

Sum of charges on document level (ibt-108)

-

Invoice total amount without TAX (ibt-109)

-

Invoice total TAX amount (ibt-110)

-

Invoice total amount with TAX (ibt-112)

-

Amount due for payment (ibt-115)

5.3. Aligned calculations

This section explains how tax is calculated in the jurisdiction as well as other rules thar are specific to the jurisdiction.

5.3.1. Calculation of Consumption Tax

A Non-tax Invoice is not allowed to have any tax amount by Consumption Tax law. So that, Invoice total tax amount in tax accounting currency (ibt-111), Tax category tax amount (ibt-117) and Tax category tax amount in tax accounting currency (ibt-190) must be zero.

<cac:AllowanceCharge>

<cbc:ChargeIndicator>true</cbc:ChargeIndicator>

<cbc:AllowanceChargeReason>Cleaning</cbc:AllowanceChargeReason>

<cbc:Amount currencyID="JPY">220</cbc:Amount>

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>10</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:AllowanceCharge>

<cac:AllowanceCharge>

<cbc:ChargeIndicator>false</cbc:ChargeIndicator>

<cbc:AllowanceChargeReason>Discount</cbc:AllowanceChargeReason>

<cbc:Amount currencyID="JPY">110</cbc:Amount>

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>10</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:AllowanceCharge>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="JPY">0</cbc:TaxAmount>

<cac:TaxSubtotal>

<cbc:TaxableAmount currencyID="JPY">5500</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="JPY">0</cbc:TaxAmount>

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>10</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

<cac:TaxSubtotal>

<cbc:TaxableAmount currencyID="JPY">2000</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="JPY">0</cbc:TaxAmount>

<cac:TaxCategory>

<cbc:ID>E</cbc:ID>

<cbc:Percent>0</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

</cac:TaxTotal>

<cac:InvoiceLine>

<cbc:ID>1</cbc:ID>

<cbc:Note>Testing note on line level</cbc:Note>

<cbc:InvoicedQuantity unitCode="C62">10</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="JPY">4400</cbc:LineExtensionAmount>

<!-- code omitted for clarity -->

<cac:ClassifiedTaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>10</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

<cac:InvoiceLine>

<cbc:ID>2</cbc:ID>

<cbc:InvoicedQuantity unitCode="C62">10</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="JPY">2000</cbc:LineExtensionAmount>

<!-- code omitted for clarity -->

<cac:ClassifiedTaxCategory>

<cbc:ID>E</cbc:ID>

<cbc:Percent>0</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

<cac:InvoiceLine>

<cbc:ID>3</cbc:ID>

<cbc:InvoicedQuantity unitCode="C62">10</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="JPY">990</cbc:LineExtensionAmount>

<!-- code omitted for clarity -->

<cac:ClassifiedTaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>10</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>6. Technical details

Following section provide technical details.

6.1. BIS Identifiers

Peppol has a defined policy that specifies how to use identifiers in both its transport infrastructure and within the documents exchanged across that infrastructure. It also introduces principles for any identifiers used in the Peppol environment. The policies that apply to this BIS are the following:

6.1.1. Profiles and messages

All messages contains Business process type (IBT-23) and Specification identifier (IBT-24). Business process type (IBT-23) identifies what business process a given message is part of, and Specification identifier (IBT-24) identifies the kind of message and the rules applied.

Profiles are connected to one business process, and may contain multiple document types. Valid document instances shall contain corresponding Business process type (IBT-23) and Specification identifier (IBT-24).

| Specification identifier (IBT-24) is a string without spaces. The list below contains spaces in Specification identifier (IBT-24) to make them easier to read. Make sure to remove any spaces before use. |

In the table below you will find the values to be used as the specification identifier (IBT-24) and the business process type (IBT-23) for this profile

| Type | Element cbc:CustomizationID |

Element cbc:ProfileID |

|---|---|---|

Invoice and credit note |

urn:peppol:pint:nontaxinvoice-1@jp-1 |

urn:peppol:bis:billing |

<cbc:CustomizationID>urn:peppol:pint:nontaxinvoice-1@jp-1</cbc:CustomizationID>

<cbc:ProfileID>urn:peppol:bis:billing</cbc:ProfileID>6.2. Datatypes

Semantic data types are used to bridge the gap between the semantic concepts expressed by the information elements defined in the semantic model and the technical implementation. The semantic data types define the allowed value domain for the content, and any additional information components (attributes) needed in order to ensure its precise interpretation.

6.2.1. Primitive types

Semantic data type content may be of the following primitive types. These primitive types were taken from ISO15000, Annex A.

| Primitive type | Definition |

|---|---|

Binary |

A set of finite-length sequences of binary digits. |

Date |

Time point representing a calendar day on a time scale consisting of an origin and a succession of calendar ISO8601. |

Decimal |

A subset of the real numbers, which can be represented by decimal numerals. |

String |

A finite sequence of characters. |

6.2.2. Semantic data types

The different semantic data types are described in the tables below, where various features such as attributes, format, and decimals as well as the basic type are defined for each semantic data type. They are based on {ISO15000}.

When used in an instance of an invoice, each data element will contain data. In the below tables this is identified as the “content”. Whenever a business term is used this term shall always have content and therefore the content is always mandatory.

Amount

An amount states a numerical monetary value. The currency of the amount is defined as a separate business term.

| Component | Use | Primitive Type | Example |

|---|---|---|---|

Content |

Mandatory |

Decimal |

10000 |

Unit Price Amount

A unit price amount states a numerical monetary amount value for data elements that contain item prices that may be multiplied by item quantities. The currency of the amount is defined as a separate business term.

| Unit price amount does not set restrictions on number of decimals, as contrast to the Amount type |

| Component | Use | Primitive Type | Example |

|---|---|---|---|

Content |

Mandatory |

Decimal |

10000.1234 |

Percentage

Percentages are given as fractions of a hundred (per cent) e.g. the value 34.78 % in percentage terms is given as 34.78.

| No restriction on number of decimals for percentages. |

| Component | Use | Primitive Type | Example |

|---|---|---|---|

Content |

Mandatory |

Decimal |

34.7812 |

Quantity

Quantities are used to state a number of units such as for items. The code for the Unit of Measure is defined as a separate business term.

| No restriction on number of decimals for quantities. |

| Component | Use | Primitive Type | Example |

|---|---|---|---|

Content |

Mandatory |

Decimal |

10000.1234 |

Code

Codes are used to specify allowed values in elements as well as for lists of options. Code is different from Identifier in that allowed values have standardized meanings that can be known by the recipient.